.svg)

California AB 488 created a modern rulebook for online charitable fundraising. It brings new oversight to websites and apps that let Californians give and sets standards for how platforms solicit, hold, and distribute donations. The law aims to protect donors and charities, and it applies to both charitable fundraising platforms and platform charities that operate or enable solicitations reaching people in California. The regulations were finalized in 2024, with registration requirements in effect beginning June 12, 2024.

A charitable fundraising platform is any entity that provides an internet-based platform to people in California and performs, permits, or enables solicitations through that platform. A platform charity is a trustee or charitable corporation that facilitates solicitations on a platform. Some entities can be both.

In practice, this captures a wide range of services. Crowdfunding sites, donation-at-checkout tools, corporate giving platforms, and peer-to-peer fundraising portals are typically within scope if they let Californians donate.

While the regulations are detailed, most responsibilities fall into several clear buckets.

Platforms must register, renew each year, and file annual reports with the Attorney General’s Registry of Charities and Fundraisers. Platform charities have notification and reporting obligations of their own, including filing the PL-3 notice when partnering with a platform.

Platforms may solicit or distribute funds only for charities in good standing. Written nonprofit consent is required before featuring a charity, subject to limited solicitation types defined in the rules.

Donations must be sent to consenting recipient charities on a timeline specified by the regulations, with the general rule requiring distributions no later than 30 days after the end of the month in which the donation was made. Platforms must maintain clear accounting and keep charitable funds separate from noncharitable funds.

The rules require specific donor disclosures, optional data-sharing with the charity, and prompt tax acknowledgments. Guidance notes that issuing receipts within five business days meets the “prompt” standard.

Taken together, these guardrails are about transparency and consumer protection, not slowing innovation. Platforms that operationalize them gain durable trust with donors and regulators.

Change was built to operationalize these obligations at scale for high-volume platforms and professional fundraisers.

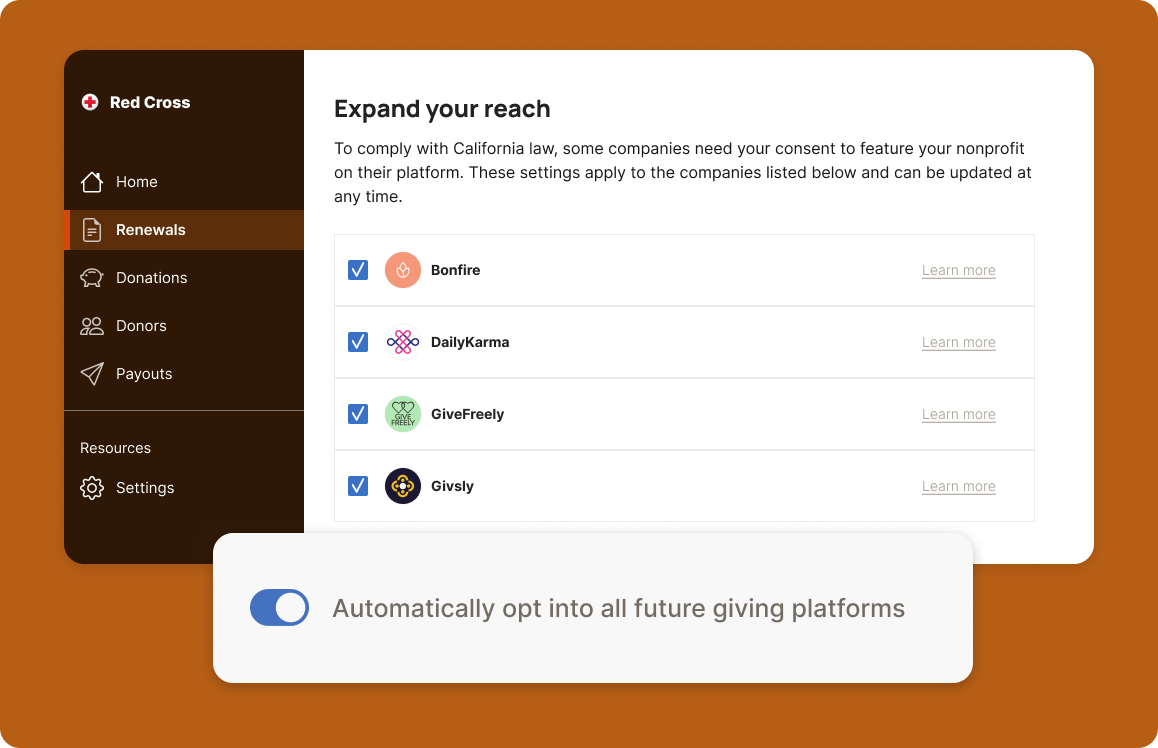

Our consent workflow collects explicit, written approval from each nonprofit before you list or promote it. Nonprofits can opt in or out through a dashboard that is simple to use, while your side stays in sync via API. This makes consent practical when you support thousands of organizations. DailyKarma, for example, automated written consent collection through Change and avoided the manual back-and-forth that AB 488 otherwise creates.

We continuously validate IRS tax-exempt status and California good standing and prevent solicitations for organizations that fall out of compliance. The law only allows solicitation and distribution for charities in good standing, so automated checks reduce risk and the chance of payout holds.

Our payout engine routes funds to recipient nonprofits on regulatory timelines and keeps charitable assets segregated from commercial funds, which the law expects. Where appropriate, platforms can use our direct-to-DAF model through Our Change Foundation for clean segregation, auditable ledgers, and simple acknowledgments.

Registration renewals and annual reports require accurate, end-to-end records. Change compiles donation and payout data into regulator-ready exports so finance teams do not piece together filings from multiple systems. Clients cite time saved and less back-and-forth with external accountants.

We generate tax donation receipts and provide the donor and charity information-sharing options the regulations contemplate. Meeting the five-business-day “prompt” standard becomes a default setting rather than a manual chore.

Platforms must cut off donations to organizations that are delinquent in California. If a charity falls out of good standing, payouts can be held or redirected, and visibility on platforms may be affected. Maintaining California registration and renewal protects revenue from platform-based giving and keeps the donor experience consistent.

If your company qualifies as a charitable fundraising platform, register and renew on time, secure written consent before listing charities, disburse funds on the required schedules, and keep donor disclosures and receipts flowing promptly. If you are a nonprofit, confirm your California status and keep required filings current so platform donations are not interrupted. The rules are clear, and the right infrastructure makes them easy to follow.

Change helps platforms and nonprofits meet these duties with automation that scales. We capture and record consent, verify eligibility, keep funds flowing on schedule, and produce the reports regulators expect, so your team can focus on campaigns, not compliance. To see how it works in practice, explore our customer stories with DailyKarma and Bonfire, or reach out for a walkthrough tailored to your program.

.png)

.png)